Nobody enjoys paying bills, but at least with Grow’s online and mobile banking, you can handle them whenever you want, wherever you are. * As you relax by the pool, pay your water bill. While you’re in line at the grocery store, pay your dog walker. We make it simple, regardless of what you’re paying for, so you don’t have to yank your hair out every time you make a payment.

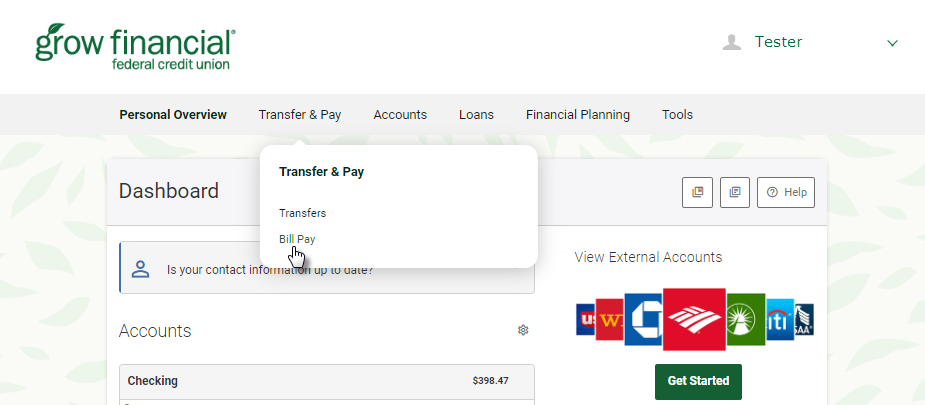

To begin, sign in to your Grow online banking account, go to the Transfer & Pay section, then select Bill Pay. Then, you can schedule automatic recurring payments.

You can even view your scheduled payments so that you can see where your money is going and can stop worrying about paying bills right away.

*Additional data charges may apply when using apps. Please see your wireless carrier for more information.

grow financial online bill pay in 3 quick steps including grow financial 24 hour customer service, grow financial customer service, grow financial phone number, grow financial login, grow financial app, grow financial auto loan, does grow financial use zelle, grow financial logout

Checkout our official grow financial online links below:

Let Bill Payments Be the Least of Your Worries – Grow Financial

https://www.growfinancial.org/online-banking-education/let-bill-payments-be-the-least-of-your-worries/

Oct 10, 2019 — To get started, log in to your Grow online banking account, …

Grow Financial: Home

https://www.growfinancial.org/

Let Bill Payments Be the Least of Your Worries. Our easy online and mobile banking services help you pay your bills whenever and wherever. Learn More.

FAQ

How do I make a payment to grow financial?

In Grow Online Banking, you can set up automatic recurring payments or make one-time payments. Once you log in, select “Transfer/Payments” from the menu. You can set up your account in just a few minutes if you haven’t signed up for Grow Online Banking yet.

How do I contact Grow Financial?

Telephone: Our Member Contact Center can be reached at 800 from 7 am to 7 pm, Monday through Friday. 839. 6328.

Does Grow Financial have an app?

Visit growfinancial to see if your mobile device is supported. org/compatibility. Up to two versions of the Android and iOS operating systems are supported by our app.

Can you overdraft with Grow Financial?

There won’t be any NSF (Non-Sufficient Funds) fees applied to this account. When you don’t have enough money in your account, transactions will be declined and returned unpaid to prevent overdrawing your account. You cannot use paper checks on this account.

Make a Loan Paymentthree convenient Payment OPtions for Your Loan

Transfer money from your 121 Financial checking or savings account to make a loan payment. It’s FREE to pay by transfer, so consider opening a checking account with us.

Pay with an External Account

Transfer funds for your business, vehicle, personal loan, or home equity line of credit from an external account.

There is a $5 service fee.

Call to Make a Payment

Ask any questions you may have and easily process your loan payment over the phone by speaking with one of our helpful representatives.

There is a $10 pay-by-phone fee.