If you’re a Wells Fargo customer, you might have experienced an issue with your bill pay check not being cashed. This can be a frustrating problem, but there are a few things you can do to try and resolve it. First, you’ll want to check with your payee to see if they received the check and if it was properly endorsed. If not, you’ll need to re-send the check. If the check was cashed but not posted to your account, you’ll need to contact Wells Fargo customer service to have them investigate. In the meantime, you can make a manual payment to your payee to avoid any late fees or interest charges.

wells fargo bill pay check not cashed in 3 quick steps including wells fargo bill pay problems today, wells fargo bill pay stop payment, wells fargo bill pay customer service, wells fargo customer service, wells fargo automatic payment cancel, wells fargo bill pay app

Checkout our official wells fargo check not cashed links below:

Bill Pay Service FAQ – Recurring Payments – Wells Fargo

https://www.wellsfargo.com/help/online-banking/bill-pay-faqs/

Answers to popular Bill Pay service questions, including costs, how to set up recurring payments , who you can pay , and more.

Online Bill Pay – Wells Fargo

https://www.wellsfargo.com/online-banking/bill-pay/

Pay your bills online with Wells Fargo’s Bill Pay service. It’s quicker and easier than writing and mailing paper checks .

FAQ

What happens if a Wells Fargo bill pay check is not cashed?

How our payment guarantee worksWe will pay any late fees or finance charges resulting directly from a delay or error on our part if Wells Fargo fails to properly complete a bill payment on or before the “Deliver by” date.Once it has been sent, a real-time payment cannot be changed or cancelled.

What happens when a bill pay check is not cashed?

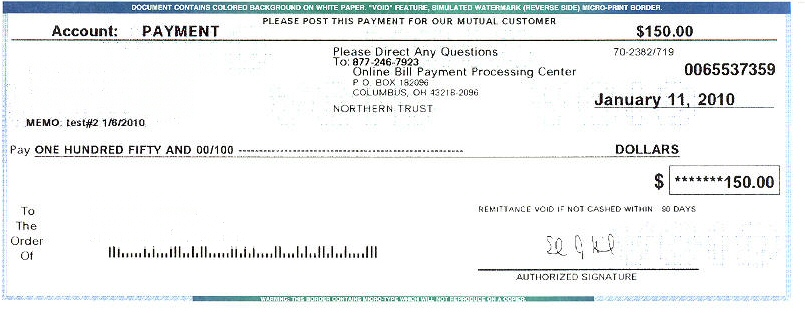

It’s frequently sent to the incorrect account or is in limbo, but the bank must conduct the investigation.Paper checks used for bill payment are sent; contact the bank to find out if they have been deposited.If not, it is returned to your account (via stop payment), and you must conduct further investigation to learn what transpired.

How long does it take for a bill pay check to clear?

It usually takes two to five business days for checks to be cleared, so it also takes that long for the bank to receive payment.The amount of your check, the account holder’s available balance, and even your relationship with your bank can all affect how long your check is held for.

Can bill pay check be Cancelled?

A series of checks and pre-authorized ACH debit transactions, such as recurring bill payments, can be stopped.Federal law mandates that you contact your bank verbally or in writing at least three business days prior to the transfer date.